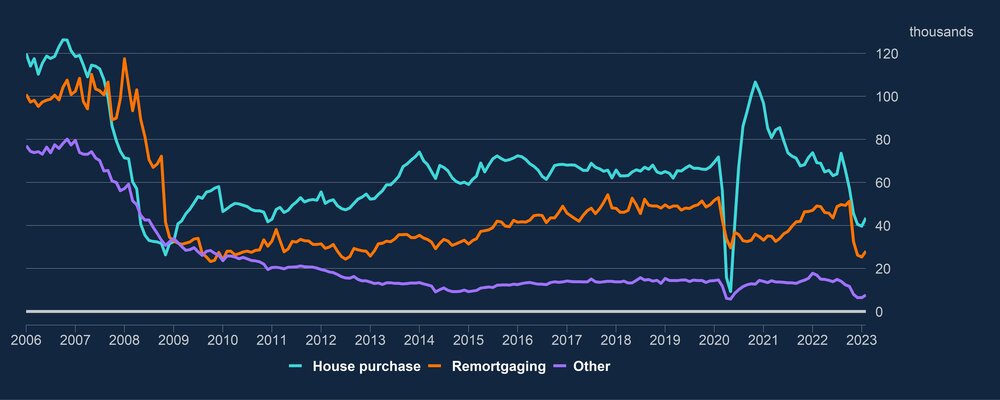

International property consultant Knight Frank reports a recovery in UK housing market activity that has been underway since January is now showing up in official figures. Net mortgage approvals for house purchases increased to 43,500 during the month February, from 39,600 in January, according to recent Bank of England figures. That’s the first monthly increase since August 2022.

Activity is still subdued relative to recent history, but things will continue to settle the further we get from the mini-budget.

“The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 36 basis points, to 4.24%. We’d expect that to stabilise in the months ahead, though much depends on whether we see any further bouts of financial instability”, says Liam Bailey, Global Head of Research at Knight Frank.