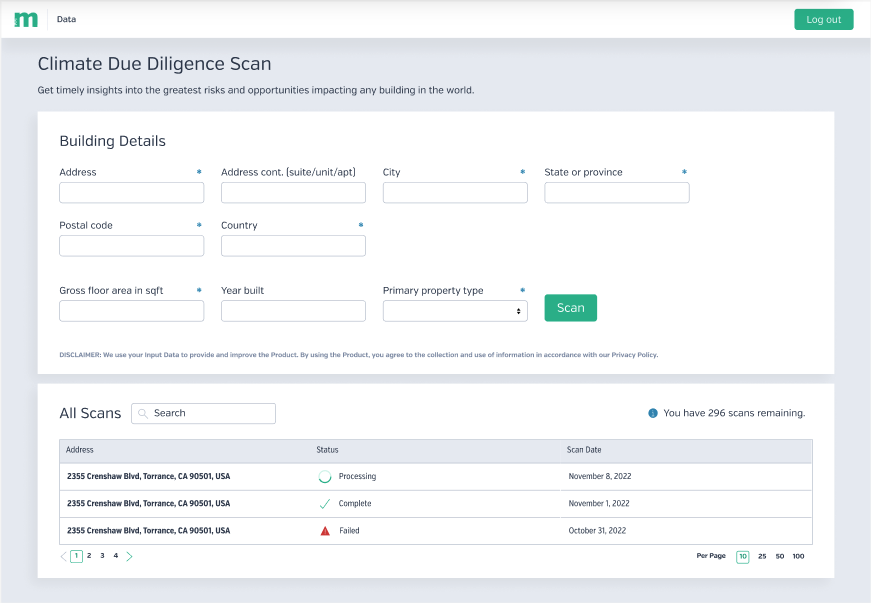

Measurabl, the world’s most widely adopted ESG technology platform for real estate, announced today the launch of Climate Due Diligence Scan (CDDS), an on-demand ESG due diligence solution that gives real estate investors, lenders, and insurers instant access to accurate, timely property-level data on any real estate transaction globally.

CDDS provides highly accurate property-level estimates derived from Measurabl’s uniquely powerful machine-learning model enabled by the world’s largest actual ESG database on real estate of more than 15 billion square feet (1.4 billion square meters), along with physical climate risk data from S&P Global Sustainable1.

“Accurate, timely environmental performance data at scale is essential for markets to price ESG risk into real estate transactions and ultimately build a more effective, efficient market,” says Gregory Michaud, Head of Real Estate Finance at Voya Investment Management.

Steve Bullock, Managing Director, Global Head of Research and Methodology, S&P Global Sustainable1 said: “S&P Global Sustainable1 is delighted to be working with Measurabl to support increased transparency of the physical risks of climate change for the critical market of real estate transactions. Our physical risk dataset uses the best available climate models and considers eight climate change hazards to enable market participants to have access to high quality data and evidence-based insights at asset level as they seek to understand and manage their exposure to the physical risks of climate change.”

For the first time ever, environmental risks like energy consumption and carbon emissions, exposure to physical climate hazards, green building certification status, and climate regulations that affect a property are all easily and immediately available. CDDS customers can also get a historical understanding of property performance relative to global, national, and state benchmarks–all in one report.

“Making any type of real estate investment decision without upfront visibility into its sustainability risks is not only imprudent, it’s unnecessary” said Sara Anzinger, Director of Data Products at Measurabl. “More than ever before, transition and physical climate risks carry financial consequences that can threaten investment returns.”

CDDS is the latest Data product from Measurabl. The company launched Asset-Level Data in early 2022, giving customers the ability to receive climate risk data on virtually any commercial building in the world, for research, disclosure, or product innovation. In November, Measurabl introduced Listed Data, offering company-level ESG data on 500 publicly listed real estate companies.