Vacation home demand hits 7-year low in 2023

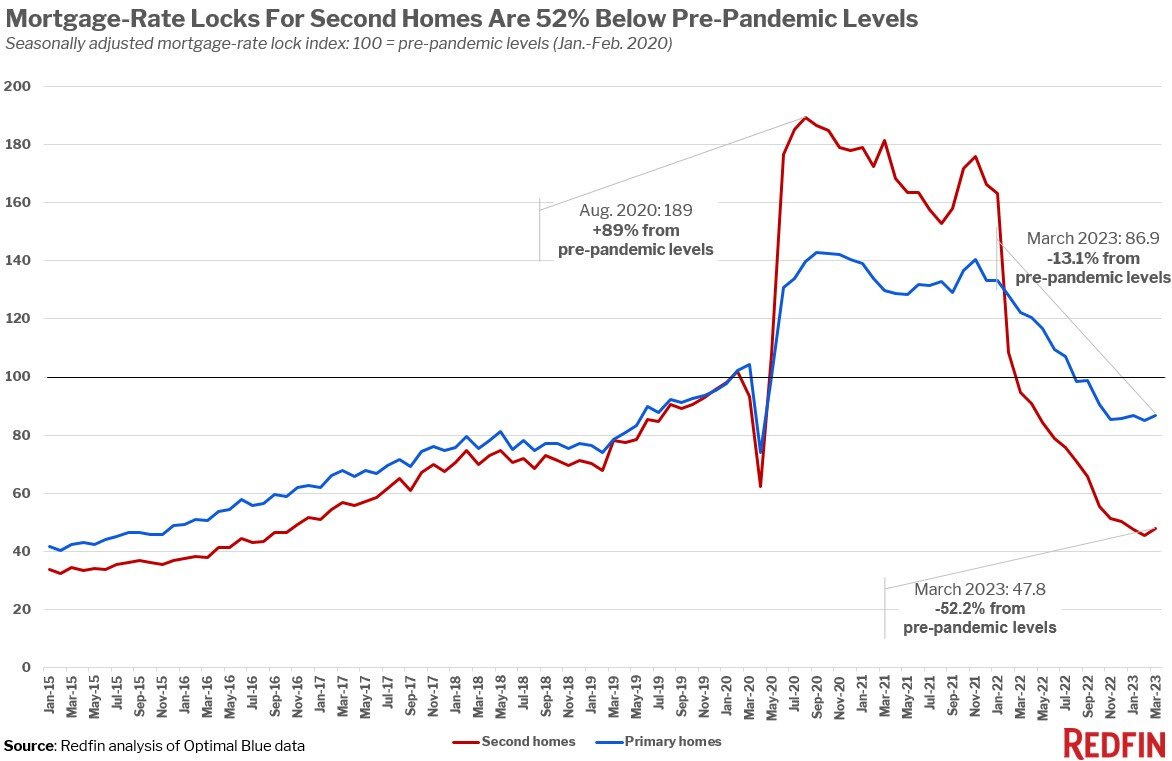

According to national property broker Redfin, mortgage-rate locks for second homes in the U.S. were down 52% from pre-pandemic levels on a seasonally adjusted basis in March 2023. That is compared to a 13% decline for primary homes.

Second-home rate locks fell to their lowest level since 2016 in February and remained nearly as low in March.

The drop in second-home demand follows a meteoric rise during the pandemic homebuying boom. Mortgage-rate locks for second homes reached a peak of 89% above pre-pandemic levels in August 2020. At that time, many affluent Americans bought homes in vacation destinations, encouraged by low mortgage rates, remote work, and limitations on traveling from place to place.

Redfin reports a variety of factors are causing the outsized drop in second-home demand:

- Many potential second-home buyers are priced out because it’s frequently more expensive to buy a vacation home than a primary home. The typical second home was worth $465,000 in 2022, versus $375,000 for a primary home. Additionally, the federal government increased loan fees for second homes in April 2022.

- Vacation-home buyers are quicker to pull back from the market than primary-home buyers because second homes aren’t a necessity.

- Workers are returning to the office. Second homes are less attractive when there’s less time to spend in them. While working from home is more common than it was before the pandemic, the share of job openings that allow remote work has shrunk since early 2022.

- Buying a vacation home to rent it out is nowhere near as attractive as it was during the pandemic homebuying and investing boom. Owners of short-term rentals are reporting a steep decline in business. That’s because many people became vacation-rental hosts during the pandemic, which led to oversupply. Many local governments are also instituting new short-term-rental regulations, like new taxes and stricter permitting. The long-term rental market is also cooling.

- Bank accounts are shrinking as stock markets decline, so would-be buyers have less cash on hand for down payments and monthly payments.

- Many people with the means and desire to buy a second home have already done so, during the pandemic homebuying boom of 2020 and 2021.

Second-home buyers are deterred by high rates, newly instituted loan fees, slowing rental market

A scarcity of new listings, elevated mortgage rates, still-high home prices and persistent inflation, among other economic woes, are holding back demand for both primary and second homes.”With housing payments near their all-time high; a lot of people can’t afford to buy one home right now, let alone a second,” said Redfin Deputy Chief Economist Taylor Marr. “Add the recent increase in loan fees, inflation, shaky financial markets, the end of pandemic-related financial stimulus and many companies calling workers back to the office, and it’s simply a challenging time for most Americans to buy a vacation home.”

But there are still some second-home buyers out there, especially in popular vacation destinations. Phoenix Redfin agent Van Welborn said some buyers are looking for vacation condos, especially in desirable neighborhoods.

“It’s mostly affluent cash buyers who don’t have to worry about high rates,” Welborn said. “They’re motivated to buy now because they think they can get a vacation home for under asking price-and in some cases, they’re right. There are fewer buyers looking to buy properties to be used as short-term rentals, though, as they’re finding that the market is saturated.”