According to new CBRE data, top end commercial transactions have been most impacted by the slow-down in investment activity in 2023, with the smaller end of the market proving to be more resilient.

CBRE’s H1 2023 In and Out Report highlights that total investment volumes dropped by 50% to $8.8 billion in the first six months of this year, compared to the same period in 2022. This includes approximately $2.3 billion worth of deals that are yet to settle, with a number subject to a capital raise.

However, while deal volumes dropped across the board, there was a significant differential between the drop in sub-$100 million transactions, at 36%, and the 58% fall recorded for deals over $100 million.

CBRE’s Head of Capital Markets Research Tom Broderick said, “The smaller end of the market has been more resilient, with private buyers seeing the current conditions as an opportunity to buy assets while larger institutional groups are largely on the sidelines.

CBRE Pacific Head of Capital Markets Flint Davidson also noted, “Asset size is currently the single biggest factor determining buyer depth on Australian sale campaigns. Over $200 million, you see interest begin to thin whereas scalable transactions were a priority18 months ago. There is still significant liquidity waiting to see pricing revert and debt markets stabilise particularly for larger assets. In overseas markets like Korea, where the interest rate cycle has topped out, buyer depth has returned so the market will be closely watching interest rate movements.”

CBRE’s analysis of the Australian commercial deals settled in H1 highlights that the office sector recorded the highest volume of transactions at $1.89 billion, followed by retail at $1.83 billion.

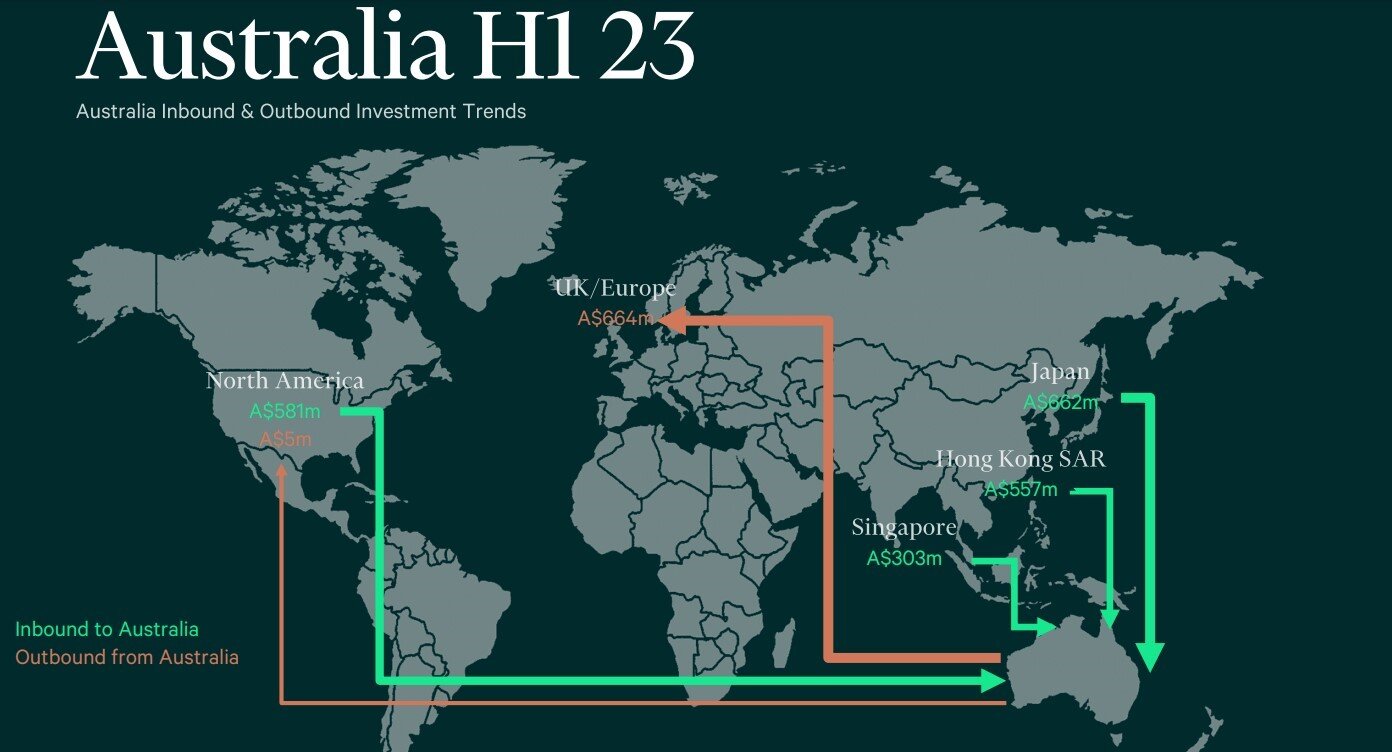

Offshore buyers accounted for just 24% of the H1 sales volume, down from 44% over the same period in 2022. This translated to $2.1 billion in total H1 2023 transactions, down 73% y-o-y, with the most significant deal being Kong Kong-based private equity group PAG’s purchase of 44 Market Street for $393 million.

While overall volumes were significant down, CBRE’s report does highlight a noticeable increase in purchases by Japanese investors, who have gained a competitive advantage due to low interest rates in Japan

From an outbound perspective, direct investment plunged 87% to $669 million relative to the same period in 2022.

“Following increased Australian investment into Asia Pacific markets in recent years, domestic groups, particularly large institutional investors, have become cautious in the current environment about buying assets directly as pricing re-calibrates around the world,” Mr. Broderick said.

Europe was the key destination for Australian capital in H1 2023, with the Netherlands the most favoured country, accounting for 36% of total outward direct investment in H1 2023, followed by the UK.