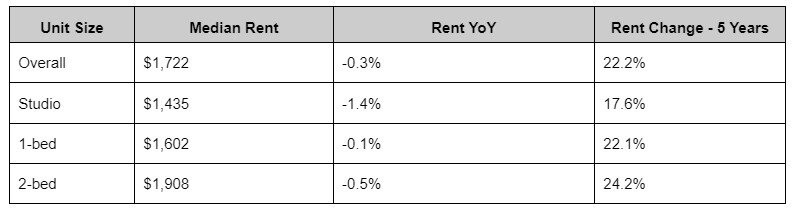

According to the latest U.S. Rental Report from Realtor.com, residential rents in March 2024 continued to fall for the eighth month in a row, with a year-over-year decrease of 0.3% across various unit sizes. Despite this trend, the median rent stood at $1,722, just $36 below its peak in August 2022, yet $313 higher than in March 2019, before the pandemic began, demonstrating the rental market’s ongoing strength.

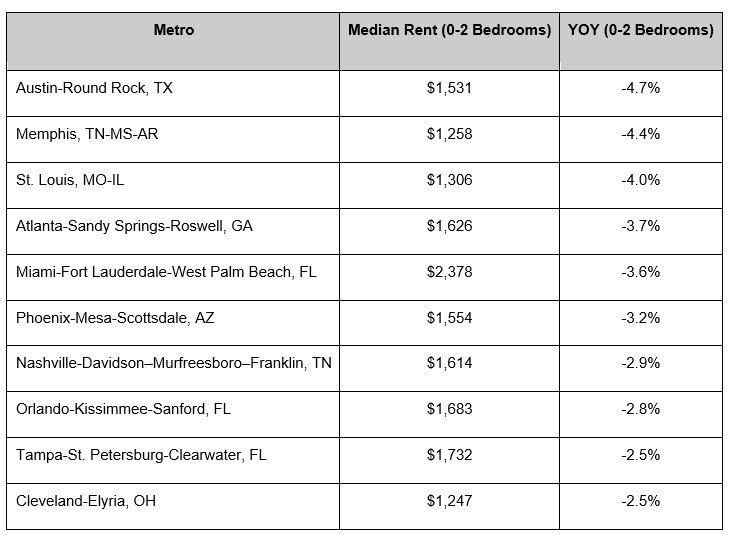

The top 10 U.S. markets experiencing the sharpest annual declines in rent prices were: Austin-Round Rock, Texas (-4.70%); Memphis, Tenn.-Ms.-Ark. (-4.40%); St. Louis, Mo.-Ill. (-4.00%); Atlanta-Sandy Springs-Roswell, Ga (-3.70%); Miami-Fort Lauderdale-West Palm Beach, Fla. (-3.60%); Phoenix-Mesa-Scottsdale, Ariz. (-3.20%); Nashville-Davidson-Murfreesboro-Franklin, Tenn. (-2.90%); Orlando-Kissimmee-Sanford, Fla (-2.80%); Tampa-St. Petersburg-Clearwater, Fla. (-2.50%); and Cleveland-Elyria, Ohio (-2.50%).

“Rising shelter costs have been a major driver of overall inflation, a top concern for the Fed as it meets this week,” said Danielle Hale, Chief Economist at Realtor.com. “There is some good news for renters with prices falling in many parts of the country, especially outside expensive metro markets in the West and Northeast. However, we expect cost pressures to continue as interest rates remain high and would-be buyers opt to rent instead and keep demand high. New housing construction is needed, especially in major markets in the Northeast and West, to alleviate the home supply shortage. Softer rents in the South are evidence that more supply helps tame rising costs.”

In the Midwest, rental rates remained stable with notable growth in cities like Chicago (4.3%), Kansas City, Mo. (3.4%), and Indianapolis (3.3%). While these areas are generally more affordable–Chicago’s median rent of $1,846 is substantially lower than that in New York and Los Angeles–rising unemployment might slow or reduce rental prices further. Conversely, in the South, median asking rent decreased by 1.5% from the previous year, with significant drops in cities like Austin, Memphis, Atlanta, Miami, and Nashville, despite strong demand and a low unemployment rate, influenced by a surge in new housing units.

The Western U.S. saw a 0.4% increase in median asking rent, marking the first annual rise after 13 months of reductions. Rent hikes in costly areas such as San Diego (2.9%) and Los Angeles (1.6%) occurred as more individuals chose renting over buying due to high home prices and anticipated long-term high mortgage rates. Although unemployment in the West has increased, it could delay some home purchasing plans, thereby boosting rental demand. However, some Western cities like Phoenix and Denver saw rent reductions. Meanwhile, expensive markets in the Northeast continued to experience rapid rent increases, with New York and Boston seeing rises of 3.8% and 3.3%, respectively, driven by strong labor markets and a shortage of rental supply.

Overall, every unit size saw median rent reductions in March, with studios taking the biggest hit–a 1.4% drop year-over-year to $1,435, marking seven months of continual declines. Yet, studio rents are still up 17.6% over the past five years. One-bedroom units barely changed, dropping only 0.1% to $1,602, likely because they serve as a middle ground between smaller and larger options. Two-bedroom units experienced a 0.5% decline to $1,908, continuing an eight-month trend of year-over-year decreases, although they’ve seen the highest growth rate over the past five years, up by $372 (24.2%).

National Rental Data – March 2024

Top 10 metros with the largest year-over-year declines, March 2024